Month: June 2022

How to Build a Payment App Like Venmo

Peer-to-peer money transfer applications are gaining popularity all over the world. Applications like Venmo, Zelle, CashApp, and others are attracting millions of people thanks to their easy and convenient service.

The financial sector is being increasingly digitized in recent years, and currently, every financial institution, even the most conservative banks, is trying to provide their customers with some sort of mobile experience. P2P applications set the trends in the fintech industry by providing convenient and fast money transfer services.

In this article you’ll learn how to build a P2P payment app of your own: I’ll share the secrets of smooth user experience and the financial models of the best fintech apps. Let’s dive in.

What is a P2P payment app and why should you build one?

A peer-to-peer payment application is a third-party app that allows people to send money to each other directly, remotely, and fast. Such applications simplify the payment process and allow users to send money without writing checks, going to a bank branch, or to the ATM. With a P2P app, the money is being deposited from a bank account, credit, or debit card.

Peer-to-peer payment services partner with different banks and financial systems like Visa, MasterCard, American Express, and Discover. They exchange data with them about the money transactions and charge a fee for processing them.

P2P applications are a part of a global digital trend, and in 2022 they’re expected to reach a global value of $14 trillion, according to Statista.

Peer-to-peer payment apps have two major growth factors:

- The interest of their target audiences in innovative technologies

- The convenience and speed of digital transactions

Millions of people value quick money transactions and are already used to them in their everyday lives. Each year, the number of downloads of the top 10 peer-to-peer payment applications in Google Play and App Store increases by 12%, and in 2022 the total number of downloads is over 32% higher than it was in 2019.

In 2021, PayPal was one of the most popular mobile payment apps of this type, having the most active users and downloads, with 53% of monthly active users opening the app each day. PayPal is undoubtedly the leader in the P2P payment world, but despite this, new payment processors continue to appear regularly and get their share of the market.

As you can see, other payment processors successfully compete with a leader, and as the instant payment market continues to grow, building an application for it is a lucrative idea. In this article, you’ll learn what features should be included in a good P2P app, what your business model can look like, and what factors influence the success of a peer-to-peer payment app.

Must-have features of a P2P application

Let’s talk about the basic functionality of a modern P2P application. All the features in your app will be determined by your user journey, industry standards, and of course your own target market. Make sure to study your competitors and test your idea in the real world before investing in a fully-fledged app.

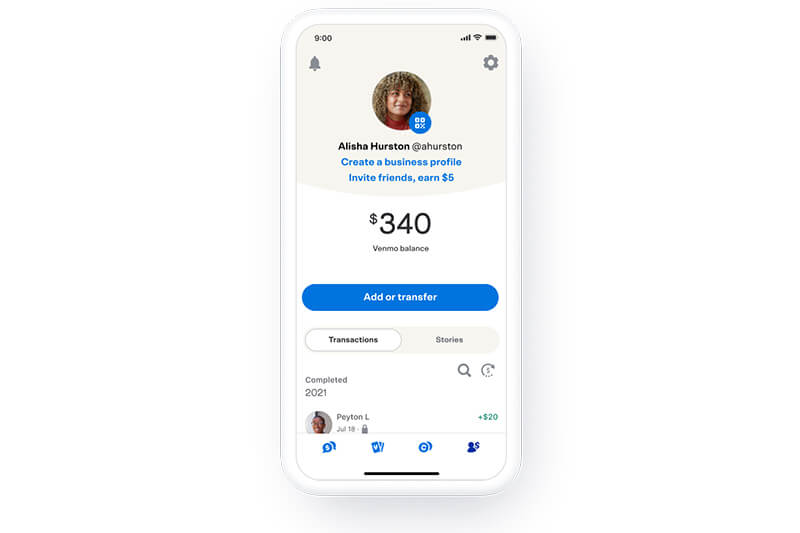

- Personal profile

A personal profile should contain all the necessary information about the user, like their name, location, preferences, and so on. Often, personal profiles contain settings, for example, payment methods, the ability to change a PIN code, or pick an app language.

- Sign up and multi-factor authentication

Make the registration process on your app convenient but secure, and of course, implement multiple factors of authentication for additional privacy. For example, you can use a phone number, PIN, and biometric information like a fingerprint. Don’t make the process of entering an app too long and tiresome, but regularly switch up the authentication methods. For example, if your user usually logs in through TouchID, do require their PIN regularly.

- Debit and credit cards

The first thing your user will need to do is add their credit and debit cards, which your system will withdraw money from. Usually, after this, your app will need to validate the card by charging a small amount from the card and then returning it.

- Synchronization with contacts

In peer-to-peer payment apps like Venmo, users often send money to their friends, family, colleagues, etc. That’s why you need to have contacts in your app and sync them with contacts from your user’s phone and social media. If their contacts also use your payment system, they’ll appear on the list, and the transfer will be possible without any additional data.

- Sending money

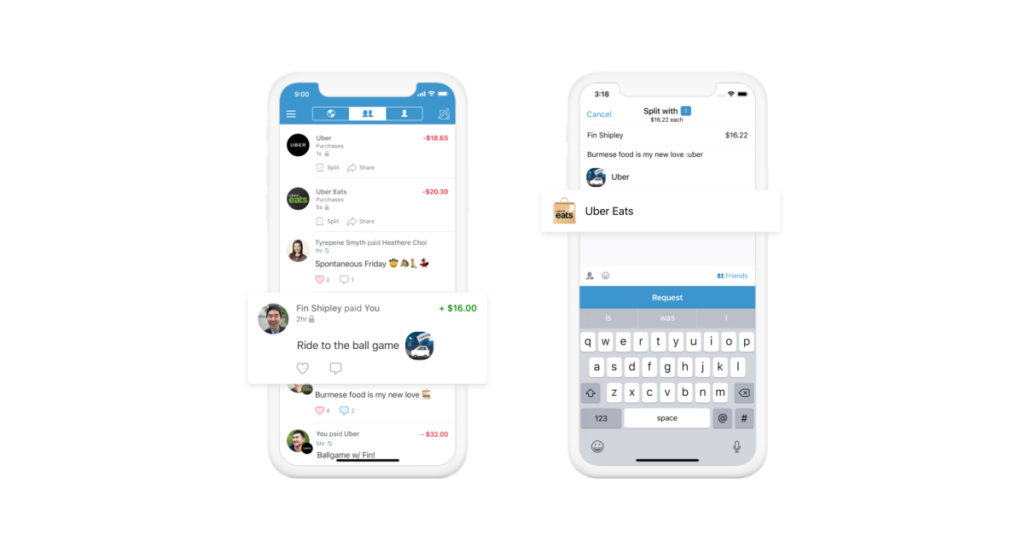

Now, this is the most important feature in your peer-to-peer payment application. The payment transfers should be convenient and fast. Also, don’t forget to notify your users about the transaction status. In Venmo, users can either send money from their cards or use Venmo money to pay the bills.

- Requesting payments

With this feature, your user can request money from other users. In Venmo, there’s an in-app messaging service that allows users to send requests and discuss the amount if needed.

- Splitting bills

Instead of tiresome attempts to calculate the share each friend needs to pay after a night out, Venmo allows users to conveniently split the bill among all participants. This is a great feature to add to your P2P application.

- Payment tracking

Your app should always show users the status of their transaction: for example, that it’s being reviewed or completed.

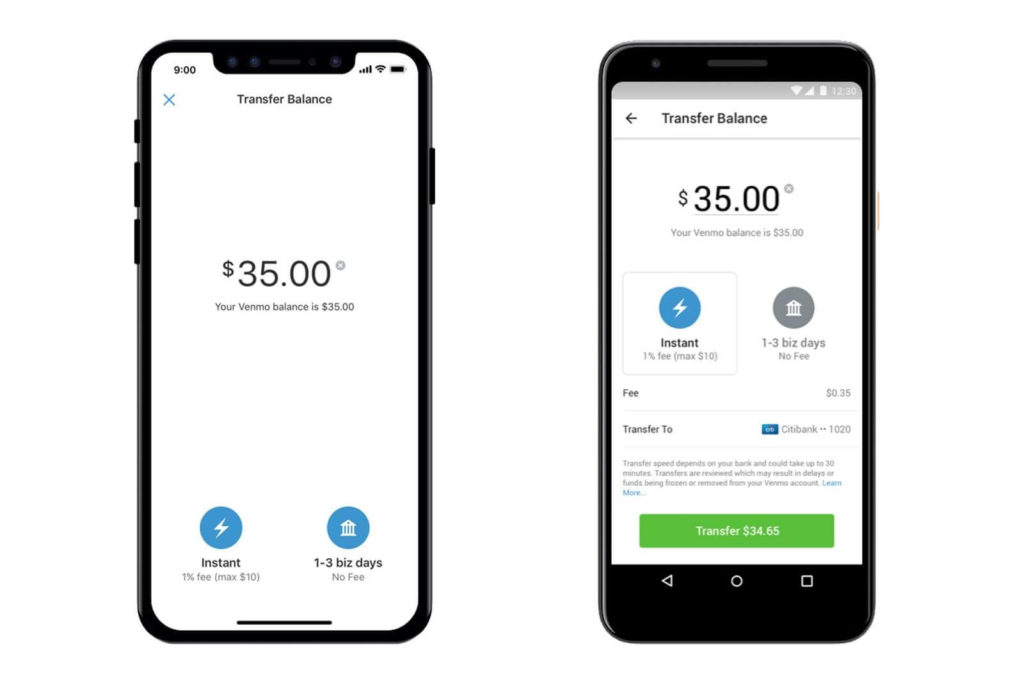

- Money transfers

Users should be able to send money from their P2P app accounts to their bank account, and from their bank account to their in-app wallet.

- Data encryption and enhanced security

Your application should be compliant with all modern security standards. All the data, especially the personal data of your users, should be encrypted. The same goes for each transaction.

- Purchasing from partner shops

Enhance your user experience by allowing your customers to purchase goods and services right from your application. For example, Venmo developed its own API, so that any business, from taxi services to flower delivery businesses, could add Venmo as one of their payment options. Venmo itself also has a list of partner businesses inside their app, where users can make purchases.

- E-tickets

In Venmo, it’s possible for users to purchase electronic tickets. After the purchase, Venmo sends the ticket to the user’s email address. You can add the same functionality for any kind of ticket.

- Notifications

Keep in touch with your users and send them notifications about their transactions and new features or special offers in your application.

- Chatbot

Get your support team to resolve complex issues by providing users with chatbot support. Chatbots can help your users to track their transactions, find out about the rules of your P2P platform, send money, make purchases, get answers to frequently asked questions, and more.

- Cryptocurrency wallet

It’s hard to imagine a fintech application that doesn’t have any sort of cryptocurrency functionality. To be on the top of the competition, you need to add a cryptocurrency wallet to your app, so that users can safely purchase and sell cryptocurrency.

How to create a P2P payment app like Venmo

Let’s now talk about the whole process of building an application like Venmo. Depending on your current circumstances, you can either hire in-house developers for your organization, or partner with a software development company. Most steps will be the same, and the major difference between these two approaches is the expenses and hassles associated with hiring and retaining your staff.

After you find a vendor or hire a team of developers and other experts like QA specialists, project managers, and business analysts, it’s time to kick off the development process. What does it look like?

Step 1. Discovery phase

A discovery phase is a planning phase of your project, where you define your business goals and expectations, conduct various research and studies, for example, competitor research or market analysis, and then plan out your application in detail.

Usually, this phase involves working with a business analyst, who extracts your requirements and turns them into a set of documents that describe all aspects of your future app. These documents include technical specifications, wireframes, prototypes, test plans, and more. The set of documents depends on your own preferences and the size and complexity of your project.

Before you start planning your app and the features it should contain, you need to imagine a user journey. What is the primary goal of your users? What different use cases does your app have, and what groups of users will be interested in them? All this will be a part of a technical specification that will describe your app’s business logic.

For example, here’s what Venmo’s major user flow looks like:

Venmo is a complex and feature-rich product, so this is only one potential journey a user might have. Usually, user journeys are reflected in wireframes and prototypes that you can test to find the perfect user experience.

Step 2. Create UI/UX design concepts

Convenience is the first reason for people to use P2P applications, and if your interface is confusing, you’ll immediately lose most of your users. It’s paramount that you invest in your user experience and interface design. Above I mentioned the user journeys; make sure you take a user-first approach in your development and test your UX at the earliest stages of development.

Step 3. Develop and test your application

When the plan is ready, the tech stack is decided on, and developers have already prepared the environment for your app, it’s time to start the development process. In modern development, testing happens along with writing the code, so these two processes will likely go almost simultaneously.

I’d recommend that you constantly test your user experience on real representatives of your target audience and also build an MVP first, so you can test your idea in real life before committing to a fully-fledged P2P payment app development.

At this stage, you also need to take care of any legal and certification requirements that are relevant for your target market.

Step 4. Test and release your application

After the development process is complete, it’s time to release an application. Given that you’ve already taken care of your marketing, users should start coming in. At this stage, your goal is to track their behavior on your app and identify any issues that may have remained. If you opted in for MVP development, real feedback from your users will give you tips on further improvement and development.

Step 5. Maintain and support your app

After your P2P application is up and running, the work only begins. Now it’s time for regular updates, security checks, and overall improvements based on the feedback from your users. Watch the competitors closely and always look for opportunities to make your service better and more profitable.

Challenges of P2P app development

Although P2P applications are a very lucrative business, there are certain challenges specific to this kind of product. Let’s talk about them.

Security

Cybersecurity is the biggest challenge for almost all kinds of digital businesses, especially those that deal with sensitive data. People trust P2P applications with their finances, and you need to do everything in your power to protect their data and each transaction that goes through.

To build a secure P2P application, you need a reliable data management system and professionals on your team that is dedicated to keeping your app secure. Security checks, penetration testing, and encryption should be parts of your regular maintenance routine.

Currency conversion

Your P2P application will work across dozens of countries with lots of different currencies, and currency conversion can be rather challenging to deal with. Your system needs to track the current exchange rates constantly and in real-time, so that the transactions are fast and accurate.

Trust

Still, not all people still trust P2P applications and other fintech products. Many people still use cash as their primary payment option, or go to banks, sacrificing convenience for reliability. Your goal is not only to attract people who already use P2P apps but also to convince those who don’t trust such products yet.

Transaction disputes

Every once in a while something goes wrong: a transaction goes to the wrong account, or the money isn’t received at all. You need to have a clear algorithm for each situation. Thankfully, there are already some compliances that explain it.

Regulatory compliance

Every P2P application is required to follow PCI DSS compliance. Here are some of the criteria for P2P apps listed there:

- Reliable access control standards

- Secure network

- Regular network monitoring and testing

- Secured confidential data

Fraud

There are many hackers that go after the money stored in e-wallets, and your application may become a touchpoint for them. You need to take care of your security and detect any unauthorized attempt to access your system. Data encryption and monitoring is the most reliable way to detect unusual activity automatically and prevent fraud.

Scaling your business

As the number of your app’s users grows, and you add more and more features to improve your service, the scalability of your application can become an issue. Your app’s architecture needs to be prepared for future growth, and it’s best to plan it before the development starts. Otherwise, you may spend too much time and money on technical changes. Some businesses even need to completely rewrite their app after they realize that the architecture can’t keep up with the growth.

Now it’s time for the next question: how much does it cost to develop a P2P payment app like Venmo? Let’s find out.

How much does Venmo-like mobile app development cost?

The cost of mobile app development services depends on multiple factors:

- Scope and functionality

- Design complexity

- Cost of third-party services and integrations

- Team size

- Deadline

- Hourly rate of your team

A Venmo-like application is a feature-rich product, so its cost will most likely start from $100k and more, depending on the number and complexity of features.

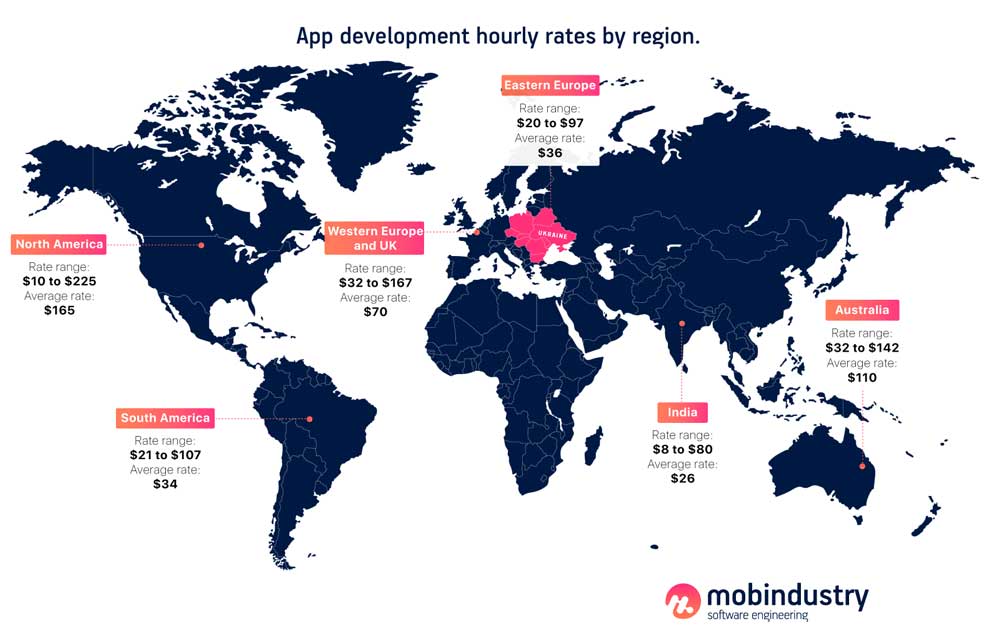

Hire experts for your project

The hourly rate of your developers and other experts influences the app cost the most, and it often depends on the location of your development vendor. For example, in the US a mobile developer charges up to $120 per hour, while in Ukraine the rate starts at $30 per hour. As you can imagine, a 500-hour project will be significantly more expensive to develop in the US, although the quality will be the same.

Our Mobindustry team developed the first version of the largest banking app in Ukraine, and has completed several other fintech projects in our 10+ years of experience

Mobindustry is a Ukrainian software development company that has over 10 years of experience in creating applications for various businesses. We developed the first versions of the largest banking app in Ukraine and completed other fintech projects around the world. If you’re looking for a reliable vendor that has security and business success as a priority, don’t hesitate to contact us.

Final thoughts

Peer-to-peer payment apps are gaining popularity across the world, and the mindset of people is slowly changing towards convenient and instant digital payments. This is reflected in the market growth as well.

P2P app development is rather challenging because of the security concerns, regulations and market expectations, however, despite all this, new P2P apps continue to emerge. If you want to build a P2P payment application, my advice is to start with a high-quality MVP and release an app to a limited market, so you can test it in real conditions as soon as possible. To later scale your app, it’s important to choose the right architecture and technical solution — and this is exactly what we are here for. We can help you with Android and iOS app development, as well as web app development for your fintech project.