Month: June 2022

7 Key Challenges Fintech Startup Faces and Their Solutions

FinTech market overview

There are several types of apps in FinTech app development, and all the challenges we mention in this article are relevant to all of them:

- Insurance

- Mobile banking

- International money transfers

- Equity financing

- Fintech loan app

- Financial education

- Retail banking

- Stock trading

All FinTech apps use technology to innovate in the financial sector. The latest trend in FinTech app development is cryptocurrency and blockchain technologies, which allow users to safely exchange money within a blockchain network.

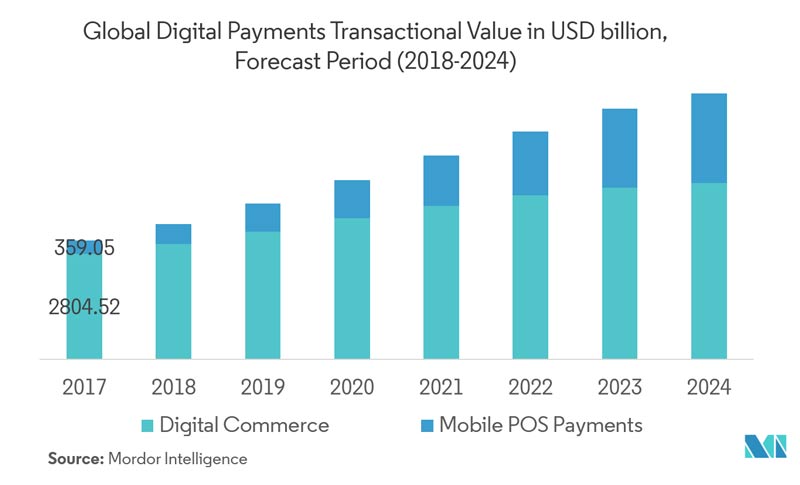

According to Market Screener, the global FinTech market will be worth $26.5 trillion by 2022, growing at a CAGR of 6%. The reasons for this rapid growth are global economic growth, a growing need for loans and insurance, and increasing interest in investments.

Though FinTech is bound for success, experts admit there are obstacles to achieving its full potential — for example, safety concerns and government restrictions. However, these aren’t the only challenges if you want to develop a secure mobile banking app or other FinTech software. Let’s talk about those challenges in detail.

Top fintech opportunities

Blockchain technology

Though blockchain is still a gray area for many businesses, fintech adopts it for fast and secure cryptocurrency transactions, but even regular transactions can benefit from blockchain. As security remains one of the biggest challenges for fintech, blockchain becomes more and more popular.

Currently the fintech industry doesn’t use blockchain to its fullest potential, so there’s lots of opportunities here. You can create a standalone blockchain-based fintech solution, or power your existing system with this technology for more security.

Open banking

Open banking is a system that allows users to securely share their payment data with third parties. This makes transactions safer and also provides convenient user experience to customers. In the UK, an open banking system allows you to use one app if you have over four different bank accounts. Consumers in the UK benefit from lower transaction costs and make direct account-to-account payments without the risks of chargeback.

Regulation technology (Regtech)

Regulations are a major challenge for the fintech industry, as the government sets its rules to prevent fraud. Regtech helps banks to monitor transactions, detect fradulent activity, create reports, cut costs for manual data management, reduce the risk of money laundering and so on .

Regtech will always be relevant for the fintech industry, as the fraudsters are constantly finding new ways of bypassing the law without being detected.

Artificial Intelligence and Machine Learning

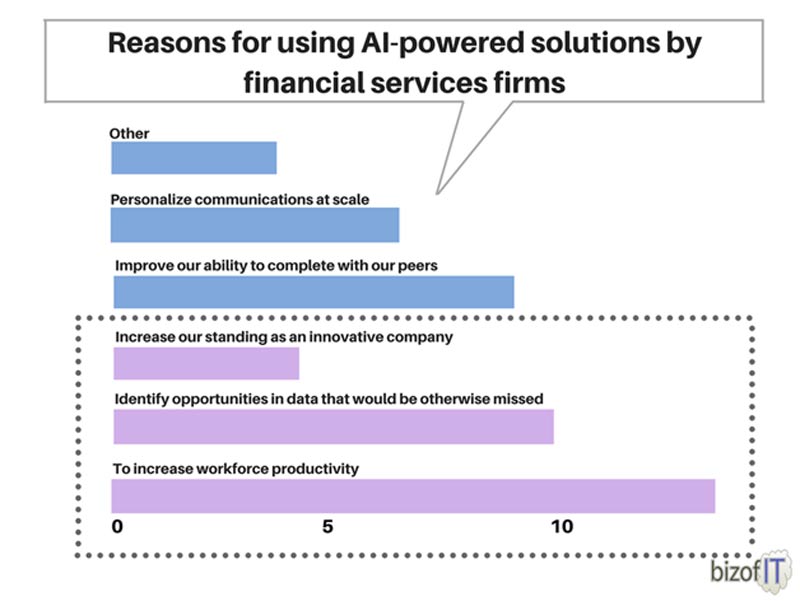

AI and ML in fintech are used for marketing, risk management, security and customer support. The advanced algorithms allow the financial institutions to cater to their customers and learn about their preferences, behavior and expectations. AI segments the audience and helps to make the service more personalized, offering new financial products that are relevant to a particular group of users.

AI in fintech can also come in the form of chatbots, that help with customer support by automatically resolving generic issues, leaving more time for human support to deal with advanced problems and provide better personal support. Chatbots work around the clock and allow financial institutions to save lots of money on human support despite the fact they currently have rather basic functions.

So, here are the benefits of implementing AI and ML in fintech software:

- great user experience

- supply chain management

- valuable insights into customer’s behavior and preferences

- personalized service

What are the main FinTech challenges?

These are the main challenges for any FinTech startup or traditional financial institution that decides to go mobile:

- Security issues and data privacy

- Big data and AI integration

- Blockchain integration

- Compliance with government regulations

- Lack of mobile and tech expertise

- Growth issues and effective marketing to acquire customers

- User retention and user experience issues

Security issues and lack of trust

Security is by far the biggest concern when it comes to mobile banking, payment apps and FinTech in general. Traditional banks have security guards, cameras, vaults, and heavy bulletproof doors to keep their assets safe.

Vulnerabilities in virtual banks are much more discreet and have potentially more impact on users

When it comes to virtual security, things start getting harder: vulnerabilities are much more discreet and have potentially more impact on users, as not only their money is at stake but their personal information too.

Solution

Just like with physical money, you need to establish a high level of protection for your FinTech app. There are many technologies you can implement to make your FinTech app secure:

- Two-factor authentication

- Biometric authentication

- Data encryption and obfuscation

- Real-time alerts

- Behavior analysis

However, it takes much more to make an app secure:

1. Constant updates — Update your software and third-party libraries and encourage users to download the newest version of your app by notifying them of updates.

2. Thorough documentation — Document each change you make to your software so you can quickly find a breach if one occurs.

3. Security testing — Test your app for security and be sure to map your software, rank the most vulnerable places in it, and pay extra attention to testing them.

4. Penetration testing — Act like a hacker and try to invade your own system to see if it’s possible and what parts of your software need extra attention.

5. Real-time monitoring — Monitor your software and your employees’ activities to be able to see where a breach has occurred. It often takes companies a long time to even understand that their security has been violated, so your records may help you during an investigation.

6. Administrator roles in the admin panel — Assign different levels of access to your employees in the admin panel of your FinTech app. This will allow you to keep your code safe and prevent internal financial and personal data leaks.

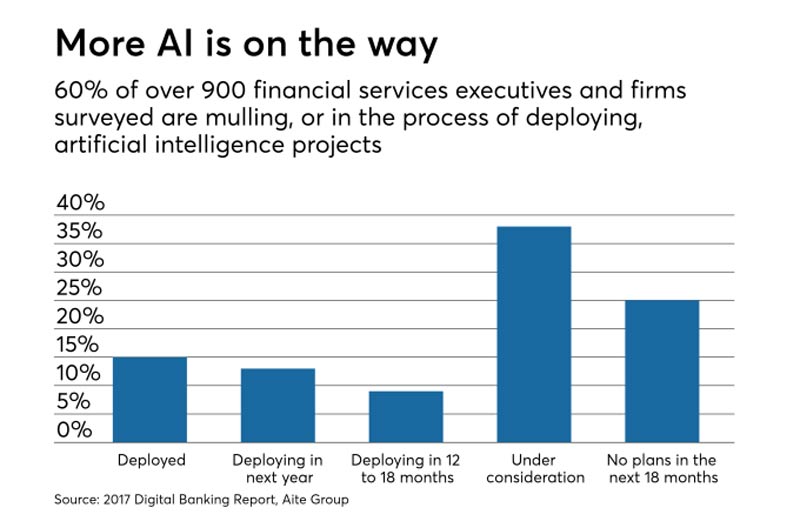

Big data and AI integration

According to Accenture, 82% of US bankers and 79% of bankers globally believe that AI will revolutionize the way banks gather information and interact with customers.

Big data and artificial intelligence are two necessary technologies for any modern banking software. Big data allows businesses to collect and organize information about a user, from their name, family members, and social status to financial behavior, habits, and in-app activity.

All this information is crucial to a bank, especially when it comes to credit ratings and offering other high-risk banking services. Combined with big data, artificial intelligence can help you automatically detect fraud, perform risk analysis, and manage transactions effectively.

However, these technologies are challenging to implement: they require exceptional engineering skills and constant maintenance.

If you already have a banking business, it will be a challenge to integrate your existing system with new high-end technologies. Doing so will require not only technical adjustments but will reshape your business and require adaptation from you, your employees, and your users.

Solution

The best solution is to hire an expert in big data and artificial intelligence and allow them to learn your business from the inside to find out your needs and determine how to meet them with industry best practices. Because banking systems are complex, just connecting AI systems through APIs won’t be enough.

For AI and big data to work together, you’ll need to teach the AI through machine learning. For this, you’ll need large amounts of data to train your system. Most banking applications are unable to process, let alone gather, such large data sets. You can solve this problem by using a one-shot learning model that allows you to train your machine learning system on smaller amounts of data.

Blockchain integration

Many FinTech applications are based on the blockchain. Some think the blockchain hasn’t lived up to expectations, while others are sure it’s the future of all data exchange on the internet.

With a blockchain, you can make your FinTech software more trustworthy, as a blockchain allows you to track all stages of a transaction and prevent any changes to it so that you can always see what’s happened to your money. However, integrating a blockchain is a challenge for many financial institutions.

So far, well-established institutions such as banks have been slow to pick up on the blockchain trend. Startups are more likely to try to disrupt the FinTech sector. However, they should take traditional banks and governments into account, as these institutions are still suspicious of new technologies.

Also, because blockchain financial technology is relatively new, there are few blockchain experts on the market. To develop and maintain a blockchain-based system, you’ll need to find, hire, and keep your own blockchain development team.

Solution

Blockchain integration requires specific expertise, so to use this technology in your mobile app, you need an expert who knows how to securely integrate it into your system.

Currently governments are still hesitant to allow massive blockchain adoption

Make sure you comply with the law and keep your reputation clean to avoid any government restrictions concerning your mobile service, as currently governments are still hesitant to allow massive blockchain adoption.

Compliance with government regulations

Finance is one of the most regulated sectors. Government regulations will be your concern even if you have more traditional FinTech software that doesn’t use a blockchain and other yet-to-be-proven technologies.

Solutions

Check your software and internal processes for legal compliance and, if needed, hire a legal consultant to lead you through all the details. Make sure your legal department is aware of the latest government policies so you can make changes immediately.

Lack of mobile and tech expertise

In many countries, finance is very traditional, and most banks don’t have proper mobile banking or other FinTech services that are convenient for users. Some banking app makers try to replicate websites, but mobile software is very different.

Lack of expertise in fintech mobile app development results in non-user-friendly applications that don’t use mobile devices to their fullest potential. For example, apps may not benefit from NFC chips, maps, geolocation features, fingerprint unlocking, and other mobile-specific features. A fintech bank is able to provide outstanding experience using these technologies.

With an infrastructure, built in physical banks, streets and shops, a banking app becomes a powerful tool. For example, a Ukrainian mobile banking software Mobindustry fintech app developers helped to develop, offers:

- Payments in public transport via a QR-code

- Payments in shops with an NFC chip

- Automatic scanning of a credit card number with a camera

- Two-factor authentication with a finger-print

All this is possible due to full integration with the devices’ hardware. There are many more FinTech ideas you can implement with just using basic features of any modern smartphone, so be sure to explore all your possibilities.

Solutions

Create your own development department or hire developers from an outsourcing company to build FinTech products app with mobile development best practices in mind. Another way to gain mobile expertise is to hire a consultant that will help you establish a development team or educate your existing team and build a strategy.

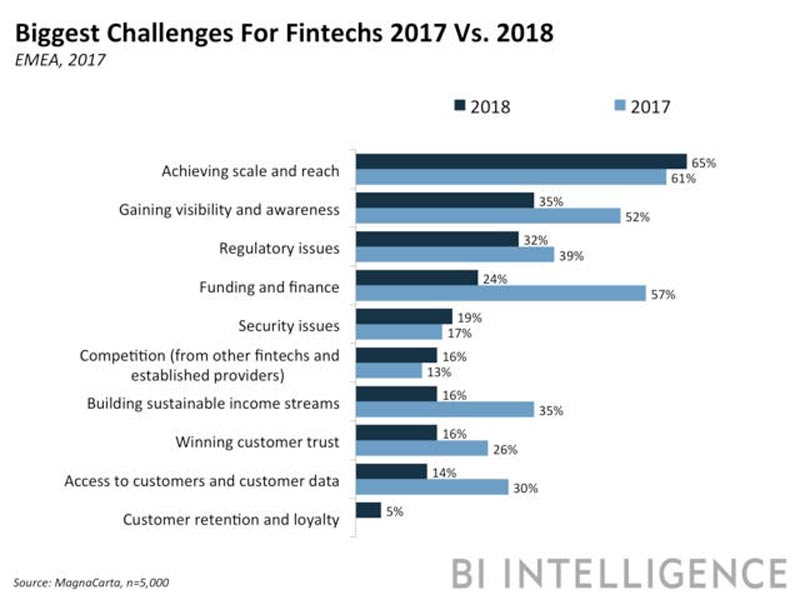

Growth issues and effective marketing to acquire customers

This challenge is about finding your niche, audience, and strategy. In the world where most people still use services from traditional banks, FinTech startups can find the competition hard to overcome.

Solutions

To grow your financial technology startup, you need to make sure you’re significantly better than your competitors. And for this, you need to either invest loads of money, effort, and human resources to bring a whole package of services to your users or you need to cooperate with traditional banks.

However, in the world where competition is so high, and attention span is so low for people, making the best product out there isn’t enough. You need to tell people about what you’ve created, and build an effective marketing strategy that should encorporate all kinds of advertising, collaborations that will help you gain popularity and brand awareness campaigns.

AdTech is what most businesses use now to promote their products, and its great for FinTech software as well. AdTech comes in all shapes and forms, from advanced AI-based advertising to voice-activated ads. You can learn more about AdTech here.

User retention and user experience

User experience and retention is one of the biggest concerns during any banking app development. A FinTech app should keep a balance between user experience and security: for example, you should make sure it’s neither too easy nor too hard to get access to a mobile banking application.

Solutions

Make sure your UI/UX decisions are both secure and user-friendly. Users won’t mind two-factor authentication, but asking them to log in using a user ID and password each time they enter the app is too much.

Your app should keep a balance between user experience and security

Conduct competitor analysis and don’t forget to check FinTech apps from other countries: you may notice an original UI or UX solution.

Wrapping up

Although traditional banking is still slow to adopt new technologies, I believe that with time, mobile technologies will become even more common in the financial sector, as they’re useful and convenient for people while helping banks and other institutions work more efficiently.

However, there are still challenges to overcome in the FinTech industry. Regulations and lack of trust from the government are challenging for FinTech companies, and in order to disrupt the financial sector, one should keep a good balance between new technologies and compliance with the traditional system.

It’s vital to constantly provide security, check your software for vulnerabilities, and update it. But also keep users in mind, giving them the best experience possible.

If you’re thinking of fintech app development, be sure to contact us. We created the first version of the biggest mobile banking app in Ukraine. It’s one of the best FinTech examples in Ukraine, and we can apply this experience to building your next FinTech application.