Month: July 2022

How to Create an Investment App: Types, Features, and Cost

Overview of the investing app market

Investing and trading used to be so complicated that you needed a special education to trade stocks and make passive income. But technologies have made investing so easy even a teenager can do it.

With the rising popularity of cryptocurrency, investing became even more popular, and now the most widely used apps for stock trading include crypto trading as well. For long-term portfolios, people choose open-end funds, which mitigate risks by distributing funds across different stocks, gold, cryptocurrencies, and bonds. Mobile apps opened lots of investing possibilities to regular people.

However, professional investors also use mobile applications, especially after the COVID-19 pandemic prevented face-to-face interactions and necessitated moving operations online.

According to Statista, 55% of Americans own stocks. A Bankrate survey shows that 63% of all smartphone users have at least one financial app on their phone, and 17% of these are standalone investing apps. This means there’s a huge market for investment applications, and though there are already many successful players on the market, new applications with creative approaches to investing appear regularly.

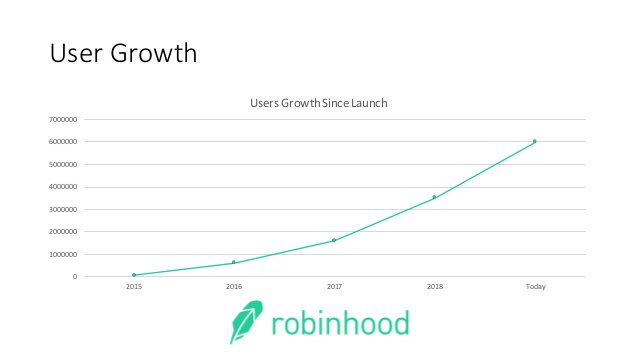

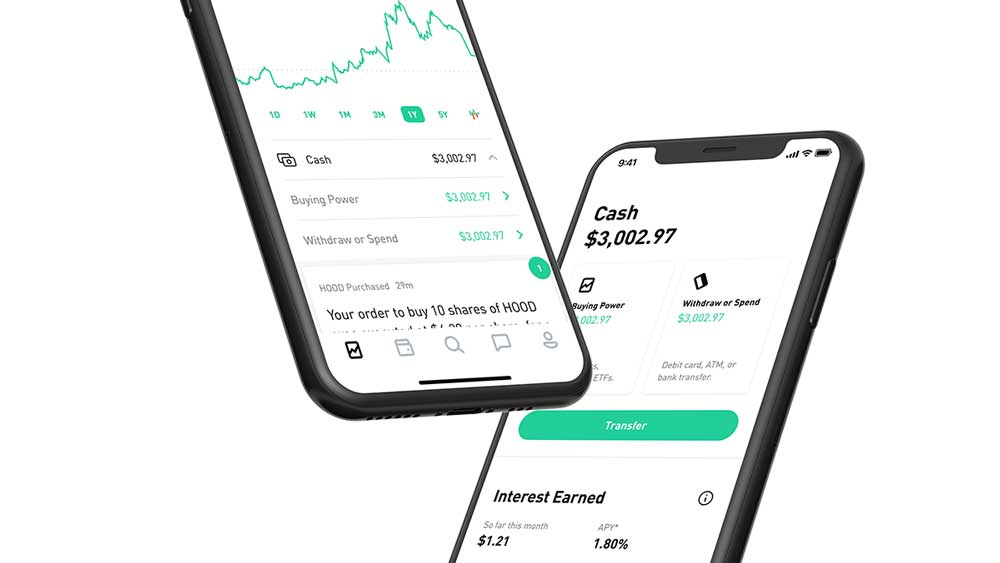

Launched in 2013, Robinhood was one of the first and has become one of the best apps for micro investing for regular people.

Robinhood’s user base has grown fast, especially between 2018 and 2020, when Robinhood claimed 13 million monthly active users. If you want to learn more about how to create an app like Robinhood, read ahead.

In this article, you’ll learn how to create an investing app, find your niche, how monetize it, and what investment apps are already successful. You’ll also discover types of investment applications and the main features such applications should have.

Types of investment apps

There are currently hundreds of investment apps that take different approaches to investing and are targeted towards different audiences. However, all of them can be divided into a few categories.

1. Banking apps

Banking applications allow users to perform banking operations from anywhere and at any time, and they often belong to a certain bank or group of banks. With these apps, users can make transactions, save money, check their balances, take out loans, and so on. Many banking apps also have investment functionality.

2. Standalone investing apps

Applications focused solely on investments usually offer a wide range of functionality depending on the target audience and market. Some of the most prominent examples include Acorns, Invstr, and Betterment. There are also apps focused on crypto, such as Coinbase and Binance.

3. Exchanged-traded funds apps

These applications give users access to stock trading, and Robinhood is one of the brightest examples of a stock trading app that’s targeted at regular people. Other apps of this kind include Vanguard and E-Trade.

In this article, we’ll focus on standalone investing applications, though you can add this functionality to any FinTech application, such as to a banking app. For now, let’s classify investment apps.

1. DIY investment apps

DIY investment applications are created for both professional and amateur investors, and they allow users to invest on the go. Some DIY investment apps have simple interfaces with basic information about market fluctuations, while others have more advanced features for professionals.

DIY personal investing apps don’t offer any consultations or advice, so they require users to be either well-versed in investing or be willing to take a risk.

For example, Binance is a cryptocurrency investment app that has two interfaces to choose from: one for quick and easy investing and another for more advanced use.

2. Robo-advisor apps

These applications provide users with guidance. They use algorithms and AI to predict future market trends by analyzing historical data. Such applications are more personalized than DIY apps, as they consider user preferences and behavior to give better investment advice.

Usually, such apps are created by robo-advisory firms.

3. Hybrid apps

Hybrid applications unite DIY investment and robo-advising, allowing any style of investing. M1 Finance is an example of such an application, letting users rely on technology while also enabling them to make decisions based on their expertise or even go with gut feelings and manage their portfolios on their own.

With M1 Finance, new users with little experience in investing won’t be lost while thinking about how to manage their investments or how to balance their portfolios, as the robo-advisor will do that for them. However, more advanced investors will have the freedom to make bold decisions and increase their chances of success with DIY functionality.

4. Human advisor apps

This can be a standalone type of app, or human advising functionality can be included in any other type of investment application. Because COVID-19 has limited interactions between advisors and their clients, human advisor apps have gained popularity. If you own an investment firm and your advisors help your clients make decisions, you can just move their interactions to a mobile environment.

How to create an investment application

While the features of your app will mostly depend on its type, the process for creating any type of FinTech investment application is similar. Let’s look at it in detail.

Step 1. Conduct market research and build your vision

You probably already have some kind of vision of how your app can help users. Before you start any fintech app development, you need to make this vision concrete and answer these questions:

- Who is your target audience?

- What’s the main goal of your app?

- How exactly will your app help users achieve this goal?

- How will your app be different from existing apps?

- How will you make money from your app?

To answer these questions, you’ll need to conduct competitor research. Look at what products are already successful and learn about market standards — in other words, features that need to be in absolutely every app of this type.

Step 2. Follow laws and regulations

Though this isn’t actually a feature, when developing any FinTech application you need to learn about laws and regulations that govern your activities in the territories in which you plan to operate and need to follow them thoroughly. Laws and regulations may apply to your users’ privacy (e.g. GDPR) and also to financial operations.

Laws and regulations you need to comply with depend on a region you plan to work in

Because laws and regulations vary across countries and regions, you need to study your exact market to find out which approvals you need to get from which institutions.

Step 3. Find your development team

There are a few ways to find product developers. Let’s quickly review them and discuss their pros and cons.

1. Hire an in-house team. This option is great because you’ll have full control over the development process and communication will be easy. However, you’ll spend time on hiring and onboarding, and you’ll also need to pay competitive salaries in your area while also offering conditions that will keep your developers at your company. Don’t forget about taxes, bonuses, pay raises, and equipment along with a workplace, which you’ll also need to pay for.

2. Hire freelancers. An investment app is a rather complex application, so you won’t be able to build it with just one or two people. For such applications, you need other specialists like QA engineers, designers, project managers, and client and server developers. It’s impossible to manage a freelance team while also meeting your deadlines and staying within your budget.

3. Partner with a software development company. This option takes the best from both worlds: you pay only for the amount of work provided, you can expand or contract your team on demand, and you also get a project manager to ensure you stay within your budget.

To find a good software development vendor, check reviews and portfolios, ask for recommendations, and conduct interviews to make sure your communication is on point.

Step 4. Create a technical specification

After you find your vendor and formulate your vision, it’s time to start planning during a so-called discovery phase, when your development team helps you translate your vision into concrete technical functionality and features.

During this phase, you will be working with a business analyst to create a technical specification — a document that serves as a guide for all team members and includes everything from features and technologies to responsible stakeholders and the project timeline.

Because an investment app is relatively complex and requires a high level of security, your QA team may need to also create testing documentation to make sure nothing is left out during development and testing.

Step 5. Build an MVP

Now it’s time to start developing your investment app. Modern development best practices suggest that testing should occur almost simultaneously with development, with QR specialists checking each part of the code right after it’s developed. This accelerates the development process.

Your minimum viable product, or MVP, will include the most important features in the technical specification. Before adding all the bells and whistles, you need to get the core functionality down and release your app to market. This way, you won’t waste any time and will be able to continue building your app according to the market response. The most important thing here is to collect feedback from the first users and look at apps similar to acorns or any other successful examples that set the bar for the whole market.

Step 6. Release and market your product

To get feedback after your initial release, I recommend starting your marketing campaign even before you launch or start developing your product in accordance with lean startup best practices.

After the release, pay attention to analytics and see how the first users behave in your app, what they have problems with, and what they’d like to see in your app next. To encourage people to install and use your product, make sure your app store optimization (ASO) is done correctly.

Based on feedback, you’ll need to plan further development of your app and add features that will improve the user experience.

Step 7. Maintain and support your app

Apart from adding new features, you’ll need to maintain those that already exist. Maintenance usually takes 20% to 50% of the initial app budget per year, and includes updates to support new operating system versions, library and third-party services updates, and so on.

It’s important to update libraries and framework versions to avoid security breaches. Also, make sure to regularly test your application for security and performance issues.

Now let’s talk about your application features, especially those you’ll definitely need for your MVP. You can change this list according to your idea, budget, and marketing strategy, but these are just the basic features that can be found in most popular investment applications.

Must-have features for an investment app

The features you need to build will depend on the type of your investment app. For example, if you offer consultations with human advisors, live chat will be one of the main features in your app.

Robo-advisory apps will need a recommendation feature and strong analytics. Let’s talk about the features that will most likely be in any investment application.

1. Registration and onboarding

You should give users options for registering with a phone number, an email address, and using other methods. Investment apps also require document verification functionality, as they should make sure users are real people.

After users register, you should give them a tour of your app: Show them around and highlight the main features and the investing pipeline.

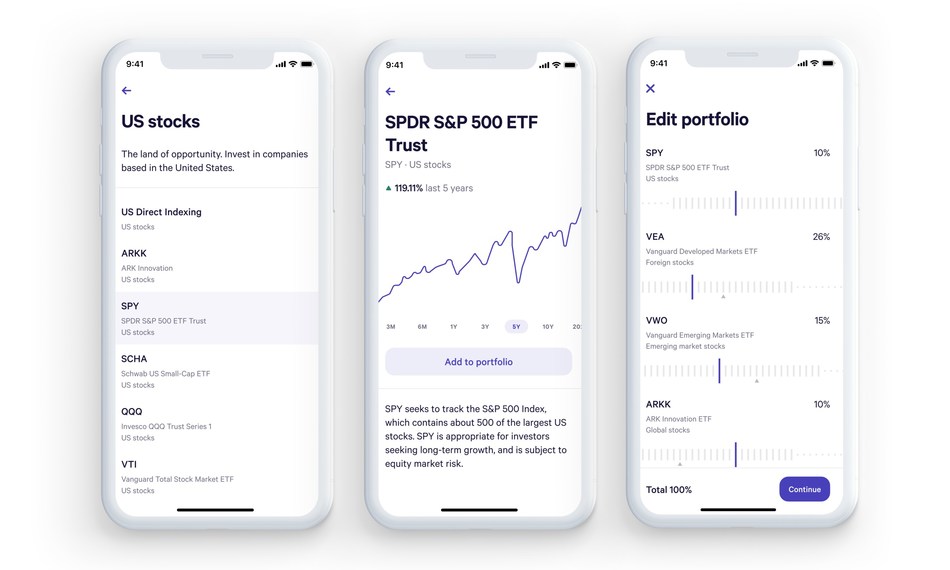

2. Investor portfolios

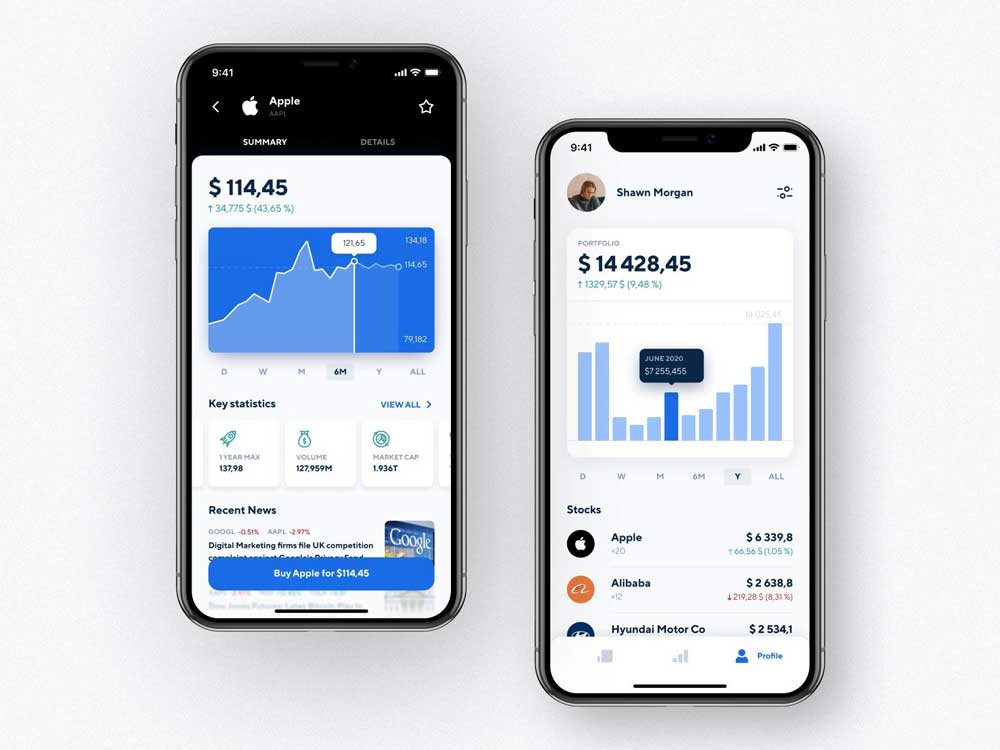

Your users should be able to manage, edit, and change their portfolios easily in the app. This means they should be able to review their assets, see stats on each asset, and diversify their portfolios.

3. Personal profiles

A personal profile should contain information about a user, preferred payment options, and the user’s portfolio. You can also add settings to personal profiles.

4. Push notifications

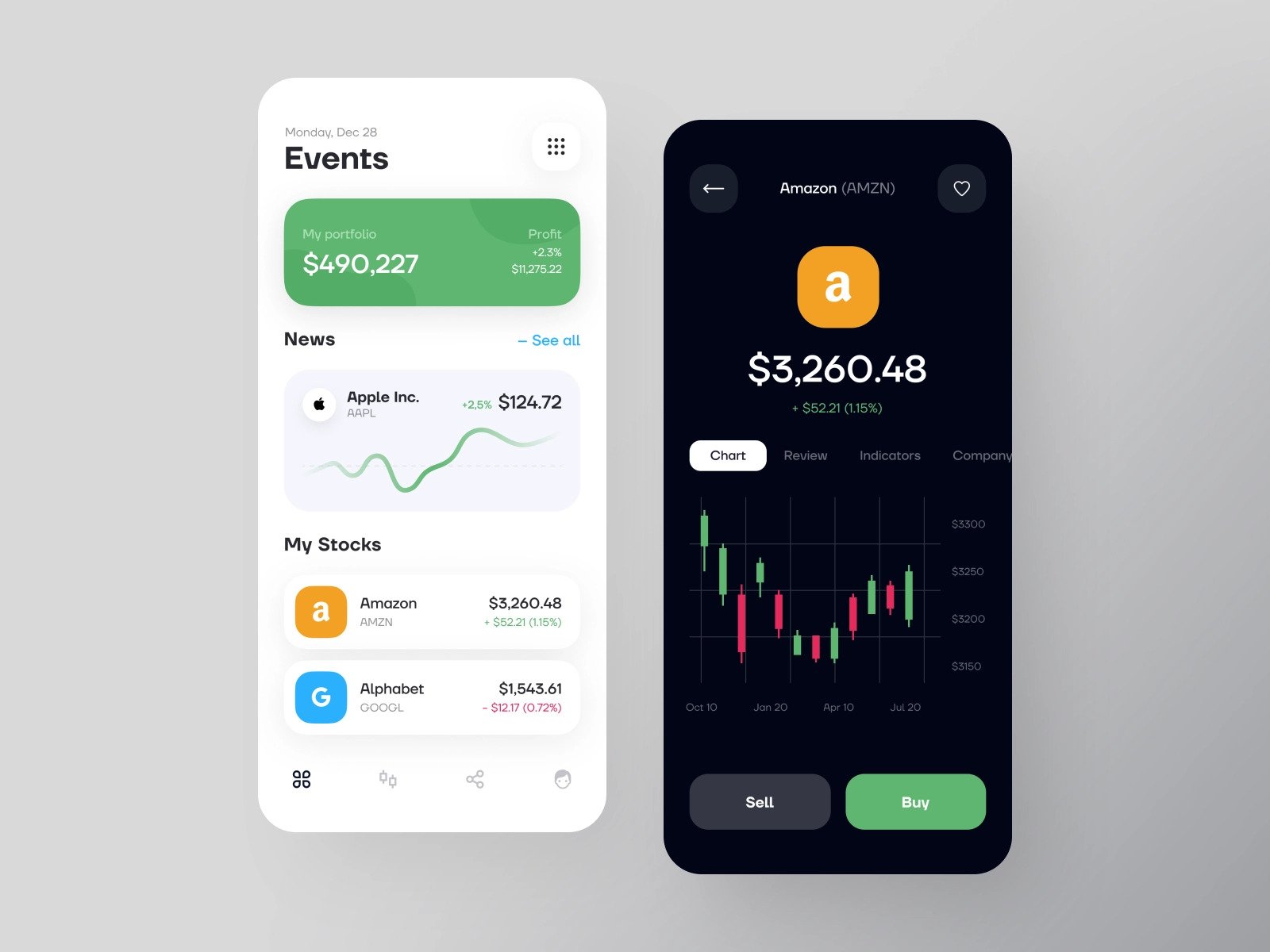

Communicate with your users through push notifications. Inform them about new investment opportunities, changes in market conditions, new recommendations from your experts, and so on.

5. Real-time analytics and statistics

Present information about market conditions in your app. Show historical data on asset performance, allow users to track their earnings, and so on. Make sure data is presented visually: Use charts and graphs to clarify information.

6. Online transactions

Integrate a secure payment system into your app for safe transactions. PayPal, Braintree, Stripe, and other payment gateways are great for this. However, consider your app’s target audience and its location, as some payment gateways won’t work in certain territories.

7. Withdrawal functionality

Your users should be able to cash out their investments to their bank accounts according to trading rules. For this, you’ll need to integrate a bank account into your application.

8. Investment option rankings

Any investing application should offer users some sort of guidance in the form of analytics or rankings. Show the most successful investment options that have shown growth in recent days or months so that it’s easier for investors to make a decision.

9. Stock search and sorting

Allow your users to search for stocks. Implement filtering and sorting, and also divide assets into categories for easy navigation. You can also make a predictive search for a better user experience.

10. Investment recommendations

Apart from providing users with rankings and visual analytics, you can implement recommendations in your app. Some applications assign human advisors to users, while others integrate robo advisors. No matter your approach, your app will be ten times better if you give users some investment guidance, especially if your app is targeted towards amateur investors.

Top 3 investment apps to learn from

Let’s now talk about the top investing apps that can serve as a guidance for creating your own best micro investing app.

Robinhood

Robinhood has taken the US by storm, offering a simple investing experience and commission-free trading. It’s targeted at non-professional traders who want to easily grow their capital, and was called one of the best investing apps for millennials.

Robinhood offers a personalized news feed that shows users information on stocks in their watchlists. This app follows all compliance requirements including those imposed by the FDIC, SIPC, and FINRA, and it offers high security.

Acorns

Acorns charges $1 per month for accounts with less than $5000 and 0.25% of the account balance annually for accounts with over $5000. Students can use Acorns commission-free for four years.

Acorns’ best feature is automated investing. The app allows users to schedule investments, and it also provides analysis and advice so they can make the best decisions. Acorns analyzes historical data to predict the future performance of investments.

Apps like Acorns or Wealthfront emerge constantly, because their business model has proven to be effective.

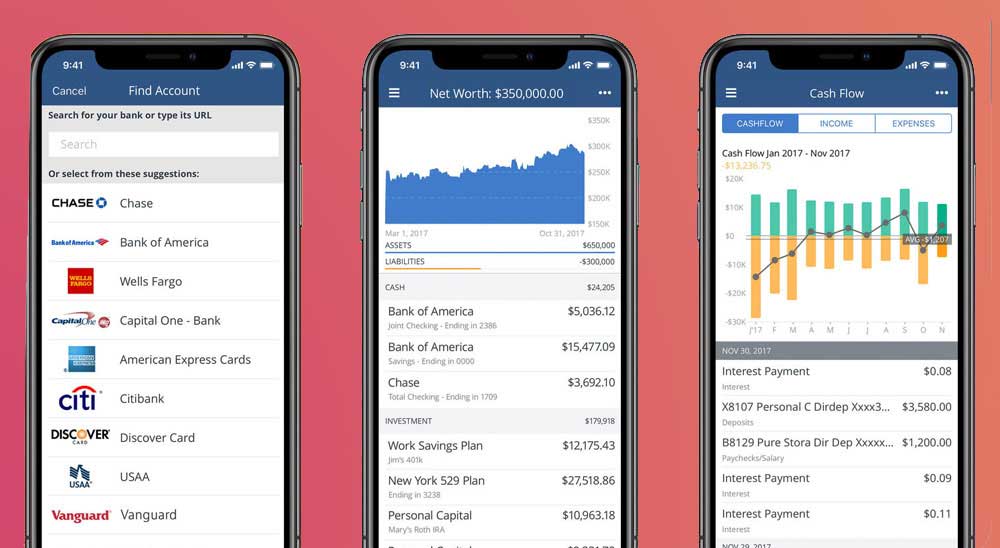

Personal Capital

Personal Capital provides personalized investment and wealth management advice. In this app, users get access to personal investment advisors who help them set investment goals and choose the best investment strategy.

Personal Capital advisors set up personalized accounts for their clients and regularly review client’s portfolios, reacting to changing market conditions and clients’ changing financial goals.

Fees for Personal Capital’s services range from 0.49% to 0.89% depending on the volume of assets being managed.

As you can see, there are lots of business models and monetization strategies for investment apps depending on the target audience, market, and regulations.