How to Create a Tax Preparation App Like TurboTax

In this article, we dive into the world of tax preparation apps, discuss the main TurboTax features and business models, and take a look at the most famous tax app out there.

What is TurboTax?

Before we talk about TurboTax, let’s answer the question: what is tax preparation software? Tax preparation software allows users to file their taxes themselves via the internet. Because the tax system in many countries is rather complicated, SaaS solutions for tax preparation are gaining popularity. TurboTax is one of them.

TurboTax is a software as a service (SaaS) tax preparation application that allows US and Canadian users to file their taxes electronically. TurboTax makes money from subscriptions for access to premium products and from the services of specialists. The base software is available for free.

TurboTax allows users to file returns in Canada and the US. The tax management software was built by TurboTax in 1984. Intuit purchased it in 1993, and in the course of the purchase, Intuit paid $225 million for TurboTax and its products.

TurboTax is a subsidiary of Intuit’s Consumer Tax Group based in San Diego, California (Intuit is based in Mountain View, California). TurboTax offers several tax preparation tools, including for employees, investors and rental property owners, freelancers, and small business owners.

TurboTax offers many free resources to help consumers file their taxes. These include a calculator, reform information, as well as tips, and videos. TurboTax is available on CD, on the company’s website, and on mobile phone and tablet apps for Android and iOS. The CD allows users to file their taxes offline, but the apps and website require an internet connection. Currently, TurboTax is one of the best tax management apps in North America.

In this article, you’ll learn about the TurboTax business model and how to build a SaaS product for tax preparation of your own.

What is TurboTax’s business model?

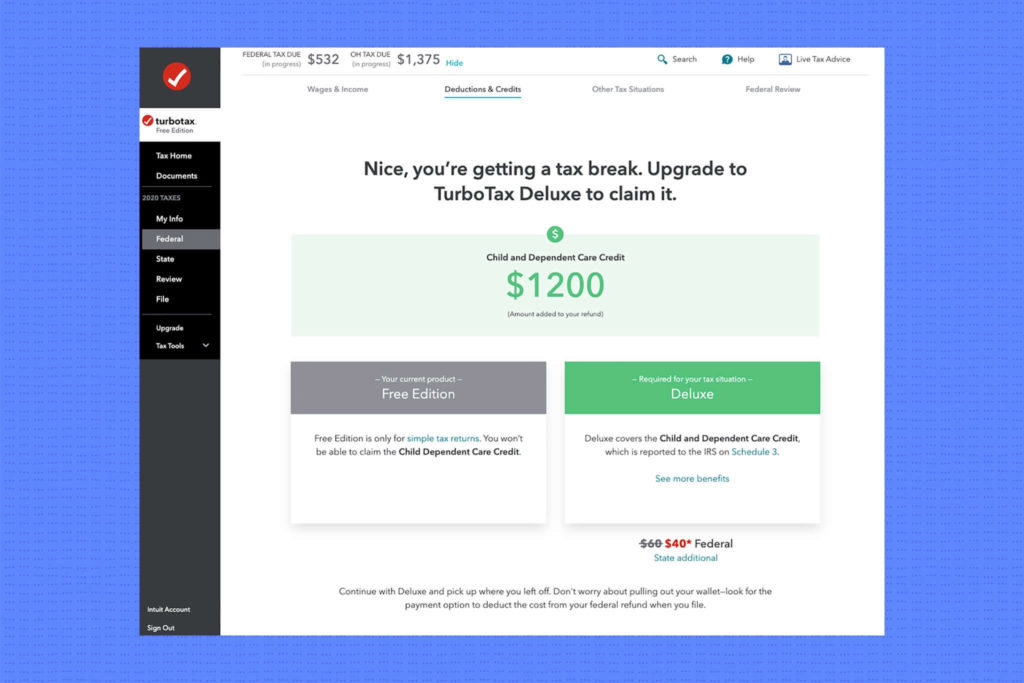

TurboTax makes money by charging for premium versions of its software as well as by offering assistance from experts. The software is built on a freemium model, which means most of its functionality is free. There are two main reasons for this:

- Using free functionality encourages users to opt for a premium version to access additional features of tax software.

- Free functionality allows users to get familiar with the platform so that when their situation becomes more complex, they already have experience using TurboTax software.

In addition to the free edition, three premium versions are available for purchase: Deluxe, Premier, and Self-Employed.

Customers pay a one-time fee to access any of the three paid plans. Prices range from $60 to $120 and are paid when filing, meaning customers need to pay for the software during each filing season. Premium versions include advanced features such as reporting investment income from bonds, stocks, cryptocurrencies, and more.

If a user needs the help of an expert, they can hire one of TurboTax’s dedicated professionals. The three versions of TurboTax offer varying levels of access to professionals. Premium TurboTax app features include the ability to speak with a professional during the tax preparation process, an interactive guide, and a final review of filings.

10 steps to develop a tax preparation app

Here are ten steps to bring your tax preparation app ideas to life and simplify the development process. Learn how to create your own tax software and what features you’ll need to implement.

1. Start locally

It’s always a good idea to research before committing to a business idea full-time. It’s wise to fix any shortcomings and take your time by starting small. When you’re working on your local market, you’re more likely to be in control, whether you’re recruiting new contractors, managing logistics, training, marketing, or delivering app updates.

2. Define your idea and concept

Developing a tax preparation app should begin with an original idea that’s embodied in a concept. Answering the following questions will help you understand how to make a tax preparation app that stands out from the crowd:

- What unique features will make your tax preparation app different from competitors?

- What is the main idea behind the app?

- What value can you offer users?

3. Identify your target audience

When developing a tax preparation app, the first thing you need to consider is the target audience. Understanding your users’ needs makes development easier and leads to a better final product. Find out as much as you can about your potential users. You can start by researching the following:

- Demographics. Find out the average age of your users, where they live, what devices they use, etc.

- Behavioral trends. Find out what decreases a user’s desire to download an app, your users’ security expectations, and so on.

To create your own tax software successfully, we suggest creating a user persona, or a detailed portrait of your ideal user.

When you’re researching your product idea and deciding how to build a tax preparation app from scratch, you should also determine who your target audience is. It’s not enough to know your target audience’s age, place of residence, financial situation, and hobbies; you need to think about your app users in terms of numbers.

The wants and needs of your target audience will determine how you build a tax preparation app and what features you offer

Once you start thinking about how to create a tax preparation app from scratch, you should start by doing initial research on your target audience. This research can be done online, where you can search for statistics, find communities, and explore other data.

The next step is to test your idea with real people. You can interact with members of interest-based communities online or in real life. The challenge is to see how your tax preparation app idea resonates with your target audience and understand how to create a tax preparation app that meets your audience’s needs.

4. Create a strategy

By now, you probably know a thing or two about how to create a tax preparation app, but there are a few more important points we should mention. It’s time to move on to the next step — coming up with a business strategy for your app.

Create a business plan for your app. How many users are you planning to get at the start? What profits can be expected? Create a pessimistic and optimistic scenario for your application, and find out how much you can afford to spend on an MVP of your tax preparation app

The wants and needs of your target audience should determine how you build a tax preparation app and what features you offer. What do your users expect from you? How do you want them to use your tax preparation app? Knowing the answers to these questions makes it easy to determine which features to include in your tax preparation app. Look at TurboTax software features for inspiration.

You can start with an initial scaled-down version of your app and then expand it with new features and innovative technologies. If your resources permit, you can immediately launch a more feature-rich app or a full-fledged product. A less risky strategy is to start small, but how to build your tax preparation app is up to you.

5. Select a web development vendor

This is one of the most important steps because the vendor’s skills and professionalism will define the quality of your app, as well as its delivery and budget. There are many ways to find a perfect vendor, either by asking for recommendations or by conducting your own research.

Whatever path you choose, you need to sift through your potential vendors and use relevant criteria to make your choice. Don’t look only at their hourly rates. Pay attention to how your vendor communicates, what they recommend, etc. Don’t hesitate to bring a third-party specialist to assess their technical skills.

6. Conduct a discovery phase

Once you’ve decided on a software provider, you can move to the discovery phase. During the discovery phase, a business analyst determines the platform’s functional characteristics. The results of the business analysis are used to create your tax preparation app’s UI/UX design, which will later be used to build the app from scratch.

7. Start the development

This stage is the most time-consuming, as it can take months to develop a basic tax preparation app and it can take years of continuous development and iteration to build a complex and non-standard app. However, a company with experienced professionals will be able to provide you with a plan for building your app.

Software testing services are just as important as development itself. The first thing you should look out for is poor performance, as slow apps tend to scare away users. Testing should be done prior to deploying the project so you don’t have to troubleshoot issues after your app is launched. Keep this in mind when looking for information on how to create a tax preparation app from scratch.

8. Define your pricing strategy

Finding the right pricing strategy is a top priority for any business venture. For some tax preparation apps, the provider sets the price; others charge for additional features. However, when it comes to money, there is always a chance to make a mistake. The most dangerous strategy is to charge too much. This can make it impossible for you to compete and negate all the effort you put into building the app.

9. Market and promote your app

Marketing is an important part of building a tax preparation app, as, without promotion, no one will find out about your new product. You can promote your app in a variety of ways, one of which is by advertising on social networks like Instagram and Facebook. Other methods include email marketing, SEO techniques, blogging, and paid advertising.

10. Perform ongoing maintenance and support

It’s not enough to know how to make a tax preparation app. You also need to know how to organize its ongoing maintenance in order for it to function effectively in the future. Typically, a good web development provider can advise you on this and provide related services.

How much does it cost to build a tax preparation app?

The cost of developing a tax preparation app depends on these factors:

- Tax preparation software features

- Product design

- Hourly rate of your development team

- Project size and complexity

- Technology stack

- Number of team members on the project

- Time frame

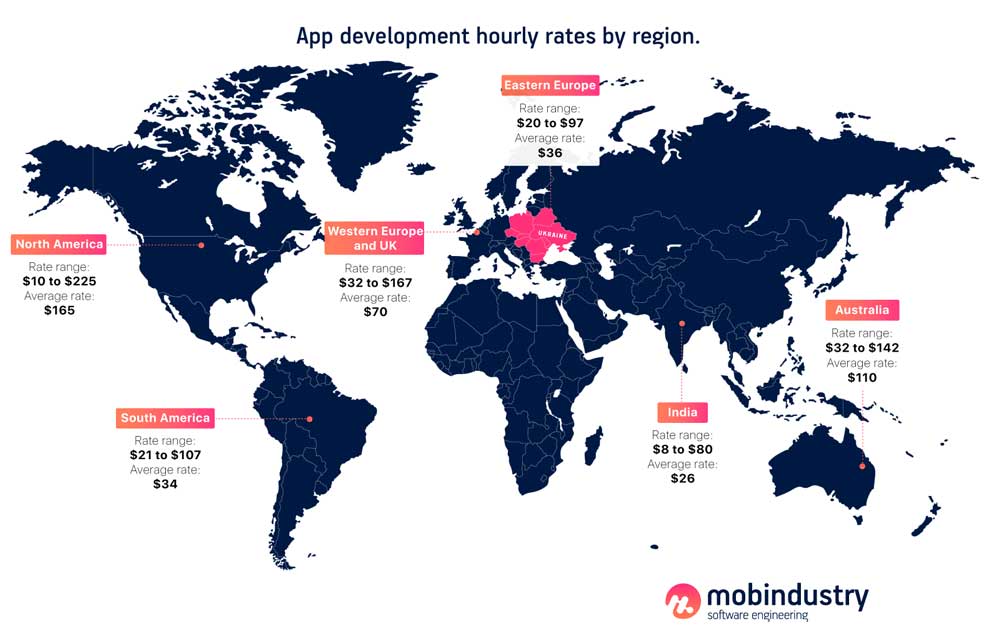

The biggest factor that influences a project’s cost is the hourly rate of developers, and that often depends on their location. For example, an application that costs $40,000 to build in the US will cost around $9,000 if developed by engineers in Ukraine.

Developing your project with a company based in Eastern Europe is cost-effective and gives you access to top talent.

Final thoughts

Now you know how to build a tax preparation app. Here are the key takeaways:

- TurboTax is tax preparation software that allows US and Canadian users to file both federal and state or provincial taxes electronically.

- TurboTax is built on a freemium model, which means most of its functionality is free.

- TurboTax makes its money from subscription fees for access to premium editions and from the services of specialists.

- When developing a tax preparation app, the first thing you need to consider is the target audience. Understanding your users’ needs makes development easier and leads to a better final product.

- Developing your project with a company based in Eastern Europe is cost-effective and gives you access to top talent.

If you want to build a tax preparation app or if you have any questions on how to build tax software, contact Mobindustry for a free consultation.