How to Use Big Data in FinTech: Strategies, Examples, Implementation

FinTech is one of the most dynamic areas of the financial sector, and whoever is best able to collect and organize data in this sector wins the competition. FinTech business owners have to take the global financial market and each of its actors into consideration

According to MarketsandMarkets, the global big data market is currently valued at almost $140 billion. By 2025, it’s expected to grow to $230 billion at a CAGR of 10.6%. This makes FinTech app development a priority for companies that are transforming financial services with big data analytics.

FinTech is one of the industries that use big data extensively due to its complex services, use of IoT technologies, and need for risk analysis and security, which requires fast operations on large amounts of data.

Big data developers help FinTechs gather an overwhelming amount of information and derive insights that really matter in the decision-making process.

What is big data?

Big data basically means large amounts of data of various kinds, and it requires particular software to collect, manage, and analyze it. This software includes big data analytics in the banking market and big data platforms that help organizations get valuable insights into how their customers use their products and services.

As businesses get more and more information from dozens of sources such as websites, applications, social networks, IoT devices, and sensors, it’s becoming increasingly hard to analyze it.

Existing technology can’t keep up with this information, and this is where big data comes into play. The term big data is rather obscure, and people may have different interpretations. Generally, there are three directions big data in the finance sector can take:

- Customer analytics

- Predictive analysis

- Real-time analytics

Data analytics in the financial services industry is so complex, that only big data technologies can cope with it.

There are three main characteristics of big data:

Volume — Traditional tools aren’t capable of handling the amount of data that needs to be handled by a big data platform.

Velocity — Data should be processed in real time, which is a requirement for most businesses.

Variety — A good big data platform should be able to process different types of data, including unstructured data like audio, tweets, status updates, and videos.

Why FinTech needs big data

The demand for big data in finance is strong, and it’s motivated by several things.

1. Lack of personal connection with customers

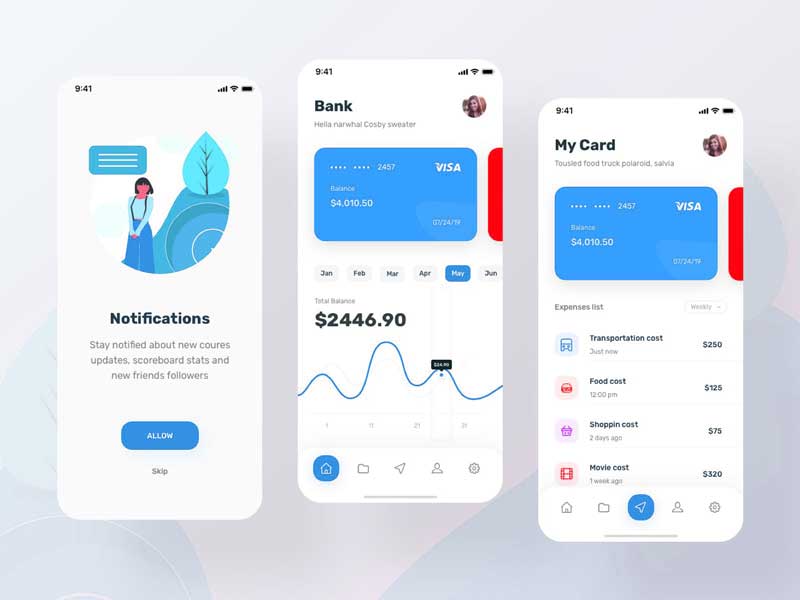

Users expect to be able to solve their issues without having to visit a bank branch, but this makes it more of a challenge to collect information about customers. Mobile devices can help. They allow businesses to collect different types of data, including geolocation, the most common user interactions, user behavior, and browsing history. This data can then be used to compensate for a lack of personal interaction with customers.

2. The rising presence of FinTech on social media

Social media is no longer just a tool to connect with friends and family: users make purchases and connect with businesses on social networks. For FinTech companies, it’s vital to examine user behavior on social media to get insights and use them when offering products or services. For example, insurers can offer special plans based on information they derive from social media, and banks can use social media data to formulate credit scores.

3. Customer expectations are changing

Customers expect businesses to not only satisfy their needs but to predict and exceed their expectations. This is impossible without information on customers. A FinTech business should gather data from multiple channels such as their mobile app, website, wearables, social media, and smart devices to form personalized offers for customers.

4. Ever-growing amounts of data

According to TechJury, in 2020, the average person generates 1.7 megabytes of data a second. This amounts to a grand total of 2.5 quintillion bytes each day for all internet users. FinTech companies feel this hit because of current trends that incorporate technologies like IoT, artificial intelligence, and integration with social media and mobile technology to collect large streams of information.

According to TechJury, in 2020, the average person generates 1.7 megabytes of data a second

New methods of authentication like biometric and behavioristic (based on mouse movements, keyboard rhythms, and so on) also require large amounts of data to work properly. Moreover, all this data needs to be processed in real-time.

5. Increasing competition in the FinTech sector

The FinTech market is growing rapidly, and each day it attracts more and more entrepreneurs, startups, and established companies. Success in this competitive market directly depends on how well a FinTech product is able to provide a service. Big data allows companies to optimize their processes in real-time and deliver the best services to their customers based on hard data.

To get ahead of competitors, it’s vital to reduce operational costs: this allows companies to allocate resources to marketing and lower prices for customers. FinTech organizations, therefore, need to automate their processes to reduce costs, and insights from big data can help with this.

Let’s discuss how big data can help banks and other financial organizations.

Benefits of big data in FinTech

Big data allows for the fast processing of large amounts of information, but what value is there in it for the FinTech business? Let’s find out.

1. Accurate data

Big data systems analyze raw incoming information and can detect inaccurate data that enters the system. This allows businesses to rely on the data they’re getting and thus use it effectively: for example, to make accurate decisions.

2. Better decision-making

It’s not only accurate data that helps businesses decide on their next steps. Big data systems provide businesses with banking and financial services analytics to not only process information but to summarize it and derive valuable insights from it. This allows businesses to get a helicopter view over their processes and clients, helping them make better strategic decisions.

3. Increased efficiency

With big data, your employees will always have the necessary data at hand when it comes to customer service, marketing campaigns, and other processes. Big data allows businesses to take a highly personalized approach to handle individual customer cases. For example, after you’ve gathered information about one of your customers through multiple channels, you can offer your services exactly when the customer needs them. This automated approach allows your employees to focus on other tasks.

Challenges of big data in FinTech

Though big data technologies have lots of benefits, it’s also a challenge to implement these technologies into your business processes. Let’s discover the main challenges of big data in FinTech and discuss how to deal with them.

1. Regulatory pressure

With today’s concerns over privacy, it’s becoming increasingly hard to collect and store data in such a way that it doesn’t violate regulations. The financial sector has even more regulations than others because financial companies are often connected to banks and store customers’ financial information.

Regulations like Basel III, FRTB, MiFID II, AML/KYC, and FATCA control the way banks collect information on their customers

To successfully integrate big data into FinTech software, you need to make sure you meet all the requirements that regulate relations between FinTech products and banks. For example, recent regulations, acts, and other compliance requirements like Basel III, FRTB, MiFID II, AML/KYC, and FATCA control the way banks collect information on their customers.

Fines for noncompliance are rising, which puts even more pressure on FinTech companies. We recommend hiring a legal advisor who will be able to analyze the way your organization uses data to make sure you comply with local laws and regulations.

2. Security issues

FinTech companies collect sensitive information on users, from geolocation and credit card information to social security numbers and information on financial activity. This is why a security breach in a FinTech product can wreak havoc.

It’s vital to carefully choose a big data platform with a securely built infrastructure and to make sure the service provider keeps a close eye on its security and constantly updates the system.

Artificial Intelligence (AI) is often used to assist big data systems: it’s able to detect unusual operations, assess risks, and detect fraud. An AI system creates a behavioral model for each user based on that user’s activity, and if there are any inconsistencies in behavior, the system reacts to them.

Must-have big data features for FinTech

After you’ve decided to integrate big data into your business, you need to carefully choose your software. It needs to be secure, reliable, and fast. I’ll first talk about the features you should look for in a big data platform, then provide you with an overview of the most popular platforms for big data & analytics for financial services you can integrate into your FinTech product.

Data processing

- Warehousing allows you to store large amounts of information.

- Modeling visualizes your data to help you understand the most important aspects of your processes.

- Real-time data processing allows you to see how users behave in your FinTech app in real time.

- Mining helps you derive insights from unstructured data and express them visually.

- Stream computing collects all data streams, analyzes their nature, and returns a single stream.

- Distributed computing divides a large task into smaller pieces that are processed on different computers simultaneously, then sends the results to a single destination where they’re aggregated.

Security

- Identity management is a security feature that prevents fraud and identity theft.

- Role management allows you to control who has access to your data and manage levels of access for each employee of your FinTech organization.

- Fraud analytics uses AI to detect suspicious activity and prevent fraud based on behavioral models.

Analytics

- Risk analysis and forecasting use machine learning to make predictions on certain actions based on previous experience. Risk analysis tools show which actions have uncertain consequences. This feature is especially useful for banking and insurance products.

- Decision management uses big data analytics in finance to suggest what options there are for each particular case. You can also automate decision-making and forecasting to increase your employees’ productivity.

- Social media analytics will help you track your social media presence and build effective marketing campaigns.

Supporting technologies

Integration with other services. Your big data platform should easily integrate with all other software you use in your work, such as your FinTech application, website, CRM, and current database.

Machine learning reduces the need to program each task, instead giving your system the ability to learn on its own based on your current processes.

Data visualization will make your employees more productive by clearly showing the most important insights.

Cloud computing makes your system more scalable and convenient, as you’ll be able to access data from anywhere.

Top 4 big data platforms for financial technology

Cloudera

Cloudera is a large big data platform that offers different kinds of data management products and services for enterprises, including cloud-based and mixed hubs, warehouses, and engineering services.

Alongside machine learning services that help businesses create and operate models, you can use these additional products from Cloudera:

Enterprise data hub delivers insights from large data streams using machine learning and risk management tools.

DataFlow streams information in real time and analyzes it for key insights.

Microsoft Azure HDInsight

Microsoft Azure HDInsight is a scalable open-source cloud-based big data analytics platform for enterprises. Microsoft Azure supports multiple development environments including Visual Studio, VSCode, Eclipse, and IntelliJ for Scala, Python, R, Java, and .NET.

HDInsights offers warehousing, batch processing, IoT device management, and the ability to expand your current on-premises big data infrastructure.

This platform allows you to process both historical and real-time information so you’ll be able to get insights on the go and compare them to what you’ve collected previously to track changes.

Vertica

Vertica is one of the most popular big data platforms. It offers these services:

- Communication and network analytics

- Customer behavior analytics

- Warehousing

- Embedded analytics

- Fraud monitoring and risk management

- Internet of Things analytics

- Time series analysis

Vertica is great for FinTech companies, as risk analysis, fraud monitoring, and customer behavior analytics are the most important features of big data for FinTech.

Vertica offers both cloud and on-premises data management services, machine learning, and data security.

Oracle Big Data SQL

Oracle provides their clients with a single database that’s compatible with NoSQL and Hadoop systems: Oracle database. It provides automated mappings and access control.

Oracle filters information with its Smart Scan feature and scores it for mining models and better processing.

When it comes to security, Oracle Database offers standard roles that govern data access across all platforms. It ensures that information is hidden when unauthorized users access it and uses a virtual private database feature to ensure compliance with governance policies.

5 top big data use cases in financial services

Now that we’ve talked about all the benefits and features of big data in FinTech, let’s figure out how exactly FinTech companies use this technology.

Fraud detection

Big data systems are able to handle so much information about each user that they’re able to feed enough information to a machine learning system. This is then used to create a virtual portrait of each user and detect unusual patterns of behavior.

Fraud detection used to be based on rules, but it was hard to predict every possible case and implement those rules programmatically without missing anything. Now, big data gives an opportunity to automate this process with less effort and flag suspicious transactions, alerting both FinTech company employees and users.

For example, if a transaction happens in an unusual location — say, in another country — and it doesn’t match with the geolocation from the user’s mobile device, the system can ask for additional verification.

Customer retention

FinTech companies fight for customers just like any other businesses, and they need information about customers to provide the best service. Big data technology helps them create detailed customer profiles to recognize customers’ current needs and make predictions for the future.

This allows FinTech companies to personalize their service and allows them to sell additional products, thus creating another source of revenue. For example, many banking apps not only provide typical banking services like financial transactions and loans but also delivery, airline tickets, and so on.

This application of big data in finance suggests that a FinTech mobile app sends just the right notifications with special offers based on a user’s behavior, age, location, and needs.

Risk modeling

Big data helps FinTech companies create detailed customer behavior models that can be compared to actual customer behavior. If a customer’s actions don’t correspond to the customer’s common behavior pattern, the system can alert the customer.

Risk modeling is also used to assign credit scores to users and thus decide how much money a FinTech company should loan them.

Service improvement

Big data allows businesses to see at which points hurdles appear in their interactions with customers. This advanced analysis helps a FinTech organization improve their services and processes, making them more efficient and accessible.

As you can see, there are lots of uses for big data in financial services that you can apply.

Algorithmic trading

Trading is a challenging task for people, as the decisions have to be made in a matter of seconds, and the amount of data that needs to be taken into account is immense. With the adoption of big data and business analytics in finance, trading became a use case of big data analytics in finance that revolutionized the way stock markets work.

Big data can help make decisions based on real-time data flow, which is extremely important in trading

To be a competitive trader, you need to process data faster than your competitors and process both traditional and non-traditional data in real time. Now financial companies can use AI instead of hiring mathematicians for data analysis: artificial intelligence and big data can use historical data to not only help with decision-making on the spot but also predict future fluctuations in the market.

Compliance requirements

Another big data application in finance is complying with government regulations. Many of the requirements that financial institutions need to meet are about thorough data recording and storing. FinTech gathers and operates so much data, that it needs big data technologies to cope with these amounts.

In order to comply with regulations and therefore be able to continue making business in FinTech, companies need advanced and powerful data processing and storing technologies.

Wrapping up

FinTech companies are adopting technology fast because of the competition, which is pushing financial organizations to make their services more efficient and convenient for end users. Big data is one of the technologies they’re adopting, allowing FinTech companies to gather information on their customers and make their services more personalized and effective.

It’s important to use big data in combination with other technologies such as machine learning and AI. This trio can help businesses make forecasts, prevent fraud, evaluate and reduce risks, and protect customers’ data. In this article, we’ve reviewed the biggest data finance use cases.

FinTech companies adopt big data technologies to be able to stay competitive on the financial market

Currently, there are lots of big data platforms you can use in your FinTech software. Choose among them according to their reliability, and make sure the platform you select complies with your local laws and regulations.

Regulations and security issues are the two biggest challenges of using big data in banking and finance. It can also be a challenge to integrate a platform with your current system, so make sure that your databases are compatible with your platform of choice.

If you want to create a FinTech product or power your product with big data development, artificial intelligence, or machine learning, make sure to contact us. Mobindustry has experience creating multiple mobile banking applications, and we can help you create a digital product that will help your business grow.